We serve Chemical Name:2-Amino-3-Benzoyl-Alpha-(Methylthio)Benzeneacetamide CAS:78281-61-5 to global customers since 2007, Pls send inquiry to info@nbinno.com or visit www.nbinno.com our official website should you have any interests. This site is for information only.

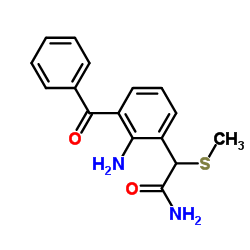

Chemical Name:2-Amino-3-Benzoyl-Alpha-(Methylthio)Benzeneacetamide

CAS.NO:78281-61-5

Synonyms:2-[2-Amino-3-(phenylcarbonyl)phenyl]-2-(methylsulfanyl)acetamide;2-[2-Amino-3-(phenylcarbonyl)phenyl]-2-(methylsulfanyl)acetamid;2-amino-3-benzoyl-a-methylthio-phenylacetamide;2-(2-Amino-3-benzoylphenyl)-2-(methylsulfanyl)acetamide;Benzeneacetamide, 2-amino-3-benzoyl-α-(methylthio)-

Molecular Formula:C16H16N2O2S

Molecular Weight:300.375

HS Code:2930909090

Physical and Chemical Properties:

Melting point:N/A

Boiling point:557.9±50.0 °C at 760 mmHg

Density:1.3±0.1 g/cm3

Index of Refraction:1.654

PSA:111.48000

Exact Mass:300.093262

LogP:1.58

Material Safety Information (Applicable for Hazard Chemicals)

RIDADR:

Packing Group:

Contact us for information like 2-[2-Amino-3-(phenylcarbonyl)phenyl]-2-(methylsulfanyl)acetamide chemical properties,Structure,melting point,boiling point,density,molecular formula,molecular weight,Benzeneacetamide, 2-amino-3-benzoyl-α-(methylthio)- physical properties,toxicity information,customs codes,safety, risk, hazard and MSDS, CAS,cas number,2-[2-Amino-3-(phenylcarbonyl)phenyl]-2-(methylsulfanyl)acetamid Use and application,Benzeneacetamide, 2-amino-3-benzoyl-α-(methylthio)- technical grade,usp/ep/jp grade.

Related News: “It’s truly an important scientific issue and important public health issue and FDA is actively exploring all regulatory options for providing access to additional doses of authorized vaccines in situations where data suggests the benefits would outweigh the risks,” Fink said. (E)-1,2,3,4-tetrabromobut-2-ene manufacturers GEM’s phase 3 program, the Champlain Survivor Relocation Fund (https://globalempowermentmission.kindful.com/campaigns/1137367) was created to assist the primary residents of Champlain Towers South Survivors with first, last, and security deposits on their new annual leases. Leading real estate firm, the Alexander Team from Douglas Elliman is providing showings at pro Bono. methyl 4-(3-((8-amino-3-(2,2,2-trifluoroacetyl)-2,3,4,5-tetrahydro-1H-benzo[d]azepin-7-yl)amino)-3-oxopropyl)piperidine-1-carboxylate suppliers So, the company’s latest announcement is wonderful news,” according to the California Institute for Regenerative Medicine, or CIRM, which helped fund development of the treatment.

“This means that UCLA will now be able to begin the process of applying to the Food and Drug Administration for permission to start an expanded use protocol to treat patients,” CIRM CEO Maria Millan said in a May 28 statement.

UCLA scientist Donald Kohn, who developed the therapy, told the Los Angeles Times that he will start the FDA process for compassionate use as soon as possible. UCLA and UCL will also seek a new commercial partner, Kohn said.

Coyle replaced former CEO Kevin King, who was with the company for nine years, having previously worked for Medtronic as the executive vice president and president of the cardiovascular portfolio. Coyle said shortly after taking over that his international experience with Medtronic will help iRhythm as the company expands into new markets.

However, Coyle’s brief tenure was defined by the Medicare pricing saga with Novitas Solutions, a Medicare Administrative Contractor.

After CMS did not set a national price for long-term cardiac monitoring last December, the decision for price-setting was then passed on to the MACs.

Novitas originally posted rates for extended cardiac monitoring between $40-$50 in late January, well below the historical $311 range.

The drastically cut rates shook industry and Wall Street analysts, and the company’s stock price dropped by nearly 33% the day of the announcement.

During his first earnings call in February, Coyle said that iRhythm met with Novitas to talk about different pricing methodologies. However, Coyle was unable to say when, or if, any changes would be made.

The pricing challenges created uncertainty for a market that Wall Street analysts were consistently bullish on amid a trend of growing wearables use.

The space even saw a flurry of deals where nearly all of iRhythm’s competition was bought up by large medtechs like Philips and Boston Scientific.

Novitas ultimately set rates for shorter-term and longer-term cardiac monitoring at $103 and $115 in April, respectively, approximately one-third of historical rates.

Coyle said on a company call that the new rates were below the costs to provide the services and higher rates would need to be set, either through another Novitas adjustment or, once again, trying to get national pricing through CMS.

Throughout the Novitas saga, iRhythm’s stock price dropped from $252.65 Jan. 29 to $62 when the market opened Wednesday.

iRhythm said Coyle’s decision to resign will not impact the reimbursement strategy going forward — the company will still pursue higher rates through Novitas, other MACs and CMS.

Analysts were surprised by Coyle’s resignation.

Truist Securities analysts wrote that during a call with iRhythm management following the announcement, the company “made clear multiple times in our conversation that there have not been any notable developments since its earnings call (which was held in early May) related to reimbursement. 4-isobutyl-2-(2-methylallyl)-2-(trifluoromethyl)oxazol-5(2H)-one vendor & factory.

“This means that UCLA will now be able to begin the process of applying to the Food and Drug Administration for permission to start an expanded use protocol to treat patients,” CIRM CEO Maria Millan said in a May 28 statement.

UCLA scientist Donald Kohn, who developed the therapy, told the Los Angeles Times that he will start the FDA process for compassionate use as soon as possible. UCLA and UCL will also seek a new commercial partner, Kohn said.

Coyle replaced former CEO Kevin King, who was with the company for nine years, having previously worked for Medtronic as the executive vice president and president of the cardiovascular portfolio. Coyle said shortly after taking over that his international experience with Medtronic will help iRhythm as the company expands into new markets.

However, Coyle’s brief tenure was defined by the Medicare pricing saga with Novitas Solutions, a Medicare Administrative Contractor.

After CMS did not set a national price for long-term cardiac monitoring last December, the decision for price-setting was then passed on to the MACs.

Novitas originally posted rates for extended cardiac monitoring between $40-$50 in late January, well below the historical $311 range.

The drastically cut rates shook industry and Wall Street analysts, and the company’s stock price dropped by nearly 33% the day of the announcement.

During his first earnings call in February, Coyle said that iRhythm met with Novitas to talk about different pricing methodologies. However, Coyle was unable to say when, or if, any changes would be made.

The pricing challenges created uncertainty for a market that Wall Street analysts were consistently bullish on amid a trend of growing wearables use.

The space even saw a flurry of deals where nearly all of iRhythm’s competition was bought up by large medtechs like Philips and Boston Scientific.

Novitas ultimately set rates for shorter-term and longer-term cardiac monitoring at $103 and $115 in April, respectively, approximately one-third of historical rates.

Coyle said on a company call that the new rates were below the costs to provide the services and higher rates would need to be set, either through another Novitas adjustment or, once again, trying to get national pricing through CMS.

Throughout the Novitas saga, iRhythm’s stock price dropped from $252.65 Jan. 29 to $62 when the market opened Wednesday.

iRhythm said Coyle’s decision to resign will not impact the reimbursement strategy going forward — the company will still pursue higher rates through Novitas, other MACs and CMS.

Analysts were surprised by Coyle’s resignation.

Truist Securities analysts wrote that during a call with iRhythm management following the announcement, the company “made clear multiple times in our conversation that there have not been any notable developments since its earnings call (which was held in early May) related to reimbursement. 4-isobutyl-2-(2-methylallyl)-2-(trifluoromethyl)oxazol-5(2H)-one vendor & factory.