We serve Chemical Name:2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole CAS:148836-24-2 to global customers since 2007, Pls send inquiry to info@nbinno.com or visit www.nbinno.com our official website should you have any interests. This site is for information only.

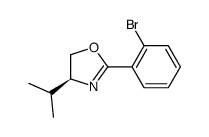

Chemical Name:2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole

CAS.NO:148836-24-2

Synonyms:2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole

Molecular Formula:C12H14BrNO

Molecular Weight:268.15000

HS Code:

Physical and Chemical Properties:

Melting point:N/A

Boiling point:N/A

Density:N/A

Index of Refraction:

PSA:21.59000

Exact Mass:267.02600

LogP:2.68610

Material Safety Information (Applicable for Hazard Chemicals)

RIDADR:

Packing Group:

Contact us for information like 2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole chemical properties,Structure,melting point,boiling point,density,molecular formula,molecular weight,2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole physical properties,toxicity information,customs codes,safety, risk, hazard and MSDS, CAS,cas number,2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole Use and application,2-(2-bromophenyl)-4-propan-2-yl-4,5-dihydro-1,3-oxazole technical grade,usp/ep/jp grade.

Related News: AstraZeneca acquired global rights to anifrolumab through an exclusive license and collaboration agreement with Medarex, Inc. in 2004. Medarex was acquired by Bristol-Myers Squibb in 2009. 2-(2,6-diethyl-phenyl)-5-[(2,3-difluoro-phenoxy)-methyl]-4-methoxy-3,6-dimethyl-pyridine manufacturers After the IPO, he now owns a 53% stake, worth $3.1 billion, plus roughly $100 million in cash and other investments, including a winery in northeastern Italy. His sons Franco and Marco (the company’s vice chairman) each own 12% stakes worth about $730 million apiece. 10-bromo-benzo[f]quinoline suppliers Another area AZ sees as a growth opportunity in China is rare diseases. In announcing its recent $39 billion acquisition of Alexion late last year, Soriot highlighted the potential to expand the Boston firm’s rare disease portfolio to China. 2-(6-Chloro-hex-4-ynyl)-2-methyl-oxirane vendor & factory.